Welcome to Coinstune.com! Today, we are delving into the fascinating world of VWAP (Volume-Weighted Average Price) and how it can work wonders for your day trading strategy. Strap in as we unravel the intricacies of VWAP and explore its applications in the volatile world of cryptocurrency.

VWAP Unveiled

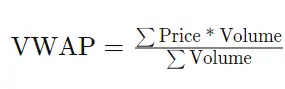

VWAP is not your average trading indicator; it’s a powerhouse of insights derived from the price and volume dynamics of an asset. Essentially, VWAP is calculated by multiplying each trade’s price by its volume, adding all this together, and then dividing by the total number of coins traded. This gives us a weighted average price that incorporates both volume and price action.

Understanding VWAP for Day Trading

Traders rely on VWAP to gauge whether a coin is trending upwards or downwards. It serves as a benchmark for assessing whether an asset is trading below or above its fair value:

- Below VWAP -> Indicates the asset is relatively cheap.

- Above VWAP -> Suggests the asset is relatively expensive.

We primarily focus on using VWAP on Lower Time Frames (LTF) for day trading, where its effectiveness truly shines.

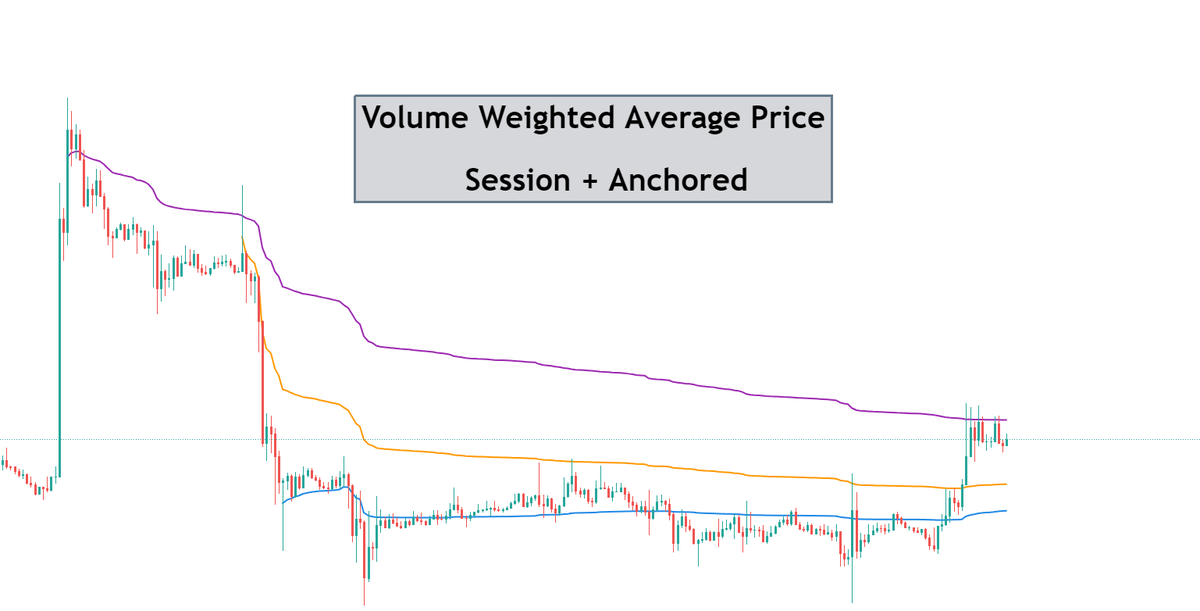

Session VWAP vs. Anchored VWAP (AVWAP)

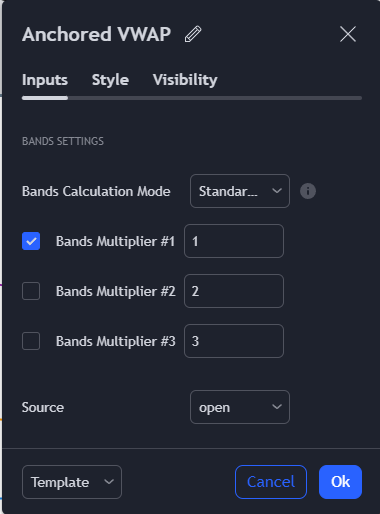

While both session VWAP and AVWAP have their merits, we find anchored VWAP to be particularly useful. Here are our default settings:

- When anchoring to a high, use ‘high’.

- When anchoring to a low, use ‘low’.

Anchoring VWAP to Key Points

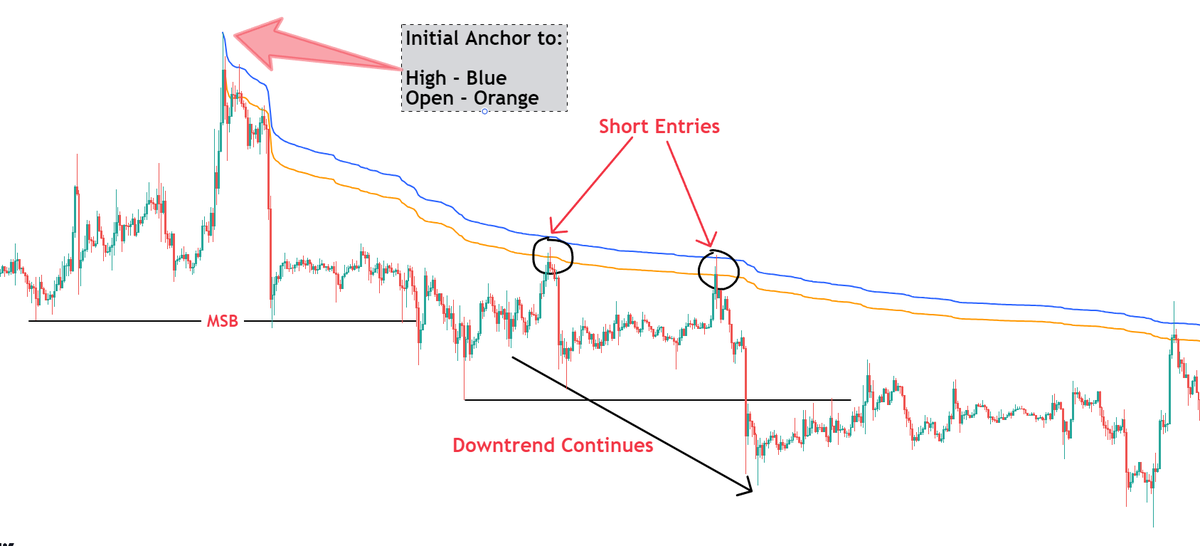

Let’s take a look at a recent Bitcoin chart to understand how to anchor AVWAP to highs/lows and opens simultaneously. It’s crucial to grasp this concept thoroughly:

Consider entering a trade somewhere between the two VWAPs. We often use AVWAP as an entry tool, employing it in two primary scenarios:

1. Trend Following Trade

In this setup, we observe immediate and violent reactions for optimal entry points. Let’s delve deeper into this strategy:

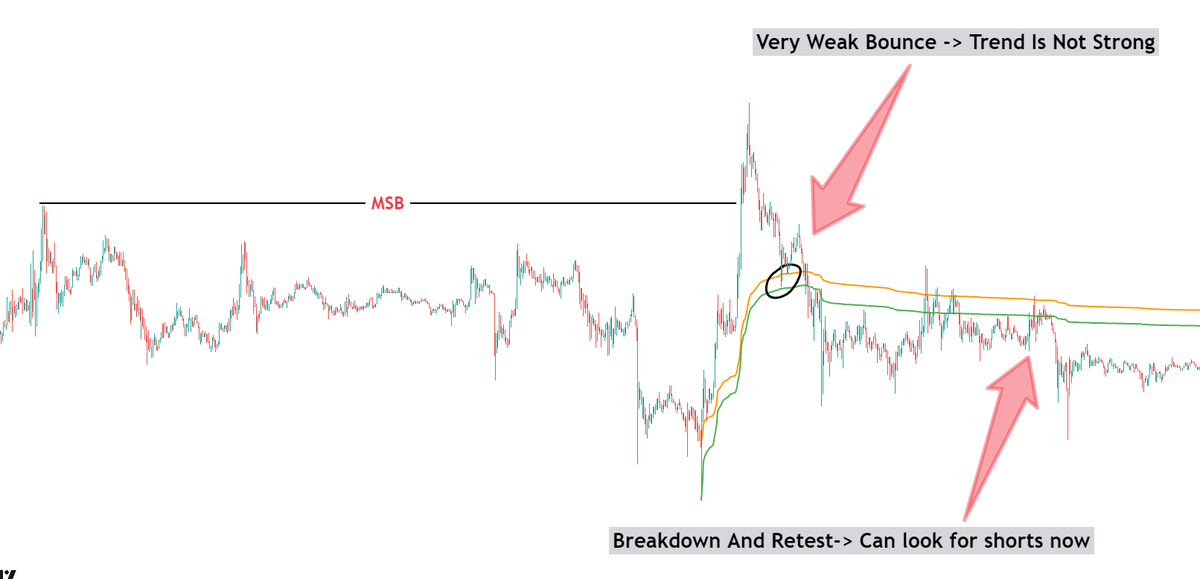

2. Trend Failure

This is a more nuanced setup requiring additional confluence. Typically, we employ scalp trading techniques in the range on a 1-minute timeframe when this scenario unfolds:

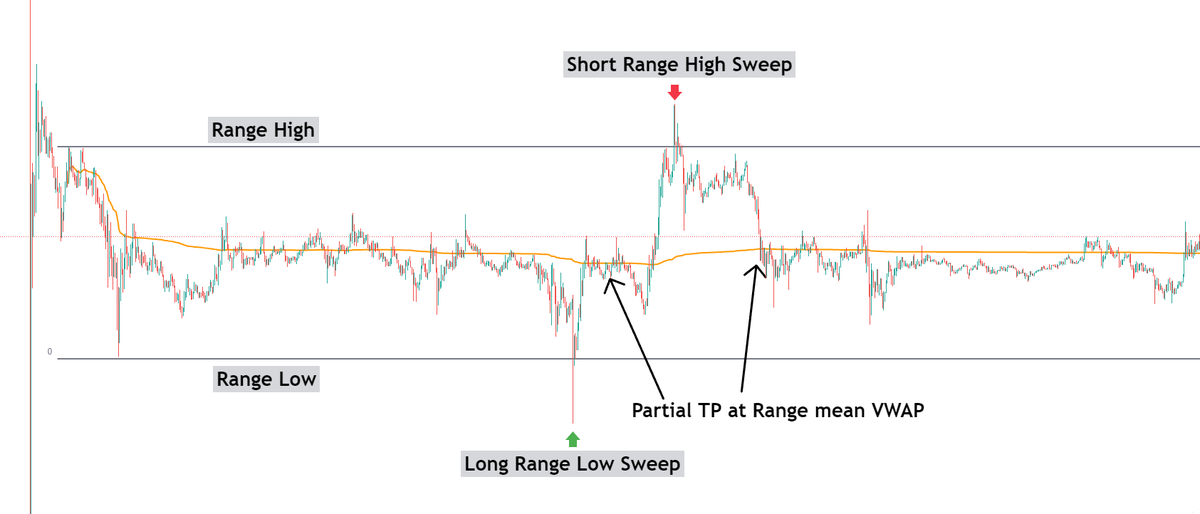

3. VWAP as Range Mean

Here, we predominantly utilize VWAP on the “open” setting. It serves as a point of interest for targets and entries, though it’s not the most recommended approach:

Putting VWAP into Action

Armed with these VWAP techniques, you can enhance your intraday trading strategy. Experiment with these methods and observe how they influence your trading outcomes.

Follow @BitWizard_01 for More Trading Tricks

For daily trading insights and strategies, follow @BitWizard_01. Discover more tricks of the trade to refine your skills and boost your trading performance.

With the magic of VWAP at your fingertips, you’re equipped to navigate the dynamic world of cryptocurrency trading with confidence. Stay tuned to Coinstune.com for more expert insights, tips, and strategies to elevate your trading game.

Happy trading, and may the markets be ever in your favor!