Swing Failure Pattern: The Only Tutorial You’ll Ever Need

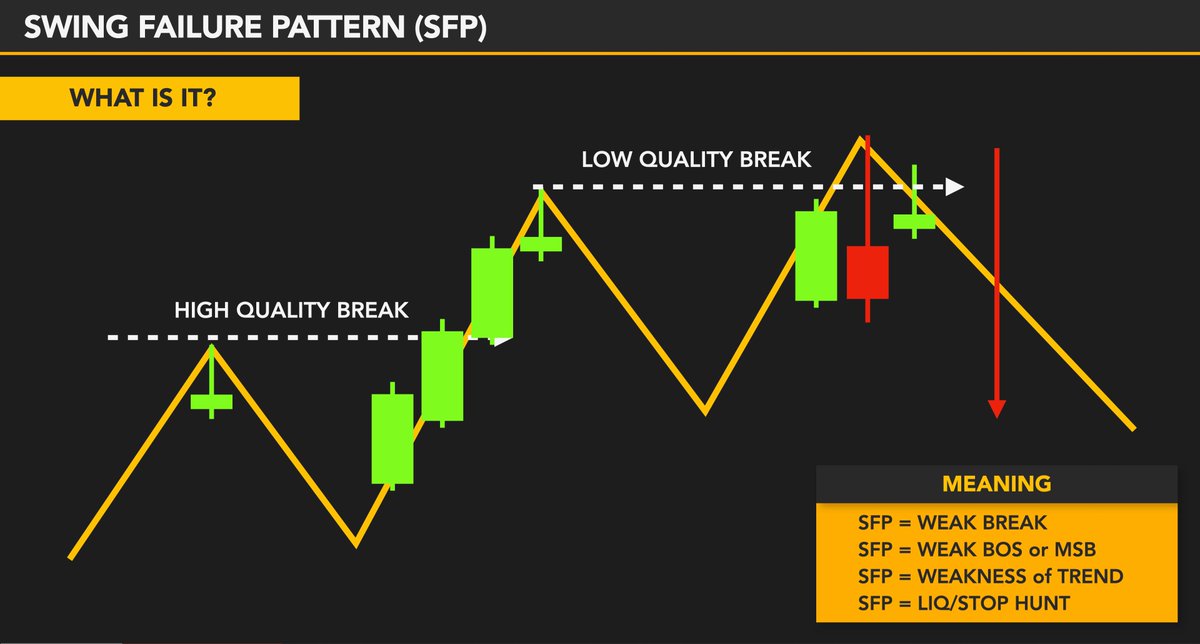

The Swing Failure Pattern, or SFP, is a potent reversal signal in the trading world. It acts as the market’s way of faking out traders before making its real move. Here’s how to identify and use this pattern.

What is an SFP?

An SFP occurs when the price surpasses a key high (or low) but fails to close above (or below) it. Essentially, it’s the market’s sneaky way of trapping traders. To spot an SFP:

- Look for a candle that pokes above a previous high (or below a low) but closes back within the wick of the prior swing point.

- This fake-out move is designed to trigger stop losses and lure traders into the wrong direction.

Avoiding False SFPs

Not every sweep of a high or low is a true SFP. To avoid trading wrong SFPs, follow these tips:

- Look for Swings: An SFP works best if there’s enough time for traders to open positions and be trapped. You need a swing away from the initial high/low for a good SFP.

- Time and Distance: Ensure there’s enough time or a significant swing away from the initial high/low to confirm the setup.

Key Point to Remember

An SFP is designed to take money away from breakout retail traders. It’s a trap for those expecting a breakout.

Real-World SFP Example

Let’s analyze a real-world SFP that ticks all the boxes:

- Swing Move: A valid SFP includes a swing move away from the high, with traders placing their stop losses above one high or another.

- Sweep of Highs: Both local and higher time frame highs are swept, trapping traders and setting up the reversal.

Managing Risk with SFP

To manage risk using the SFP setup:

- Entry: Enter the trade after the candle closes as a confirmed sweep.

- Monitoring: Instead of placing stops, monitor the setup. If the candle closes above the SFP high, take the loss.

- Safety Stop-Loss: Optionally, place a safety stop-loss slightly above the SFP high.

Practice and Refine

Trust me, Chads, the SFP is one of the best patterns you can use if you keep practicing it. Try it out, learn it, and continuously refine it according to your trading style.

Stay tuned to Coinstune.com for more trading insights, strategies, and tutorials. Happy trading, and may the markets be ever in your favor!