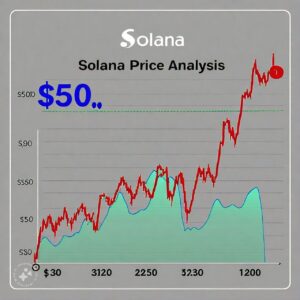

Introduction: Solana’s price has been fluctuating amidst market volatility, but recent metrics suggest a potential rally. Let’s dive into the details.

Solana’s network metrics have shown significant improvements, indicating a potential price surge. The total value locked (TVL) in Solana’s DeFi protocols has increased by 10% in the past week, reaching $1.2 billion. Additionally, the number of active addresses on the Solana network has risen by 20% in the same period.

These metrics suggest growing adoption and usage of the Solana network, which could lead to increased demand for the token. Furthermore, Solana’s recent partnership with Google Cloud to bring blockchain technology to the masses could also drive up demand.

Solana has been one of the top-performing cryptocurrencies in 2023, with a year-to-date return of over 50%. However, the token has faced significant volatility due to market fluctuations and regulatory uncertainty.

A potential price rally in Solana could have significant implications for investors and the broader cryptocurrency market. If Solana’s price surges, it could attract more investors to the token and increase adoption of the Solana network.

“Solana’s improving network metrics and growing adoption suggest a bullish outlook for the token,”

Solana’s price analysis suggests a potential rally amidst market volatility. Growing adoption and usage of the Solana network could drive up demand for the token.