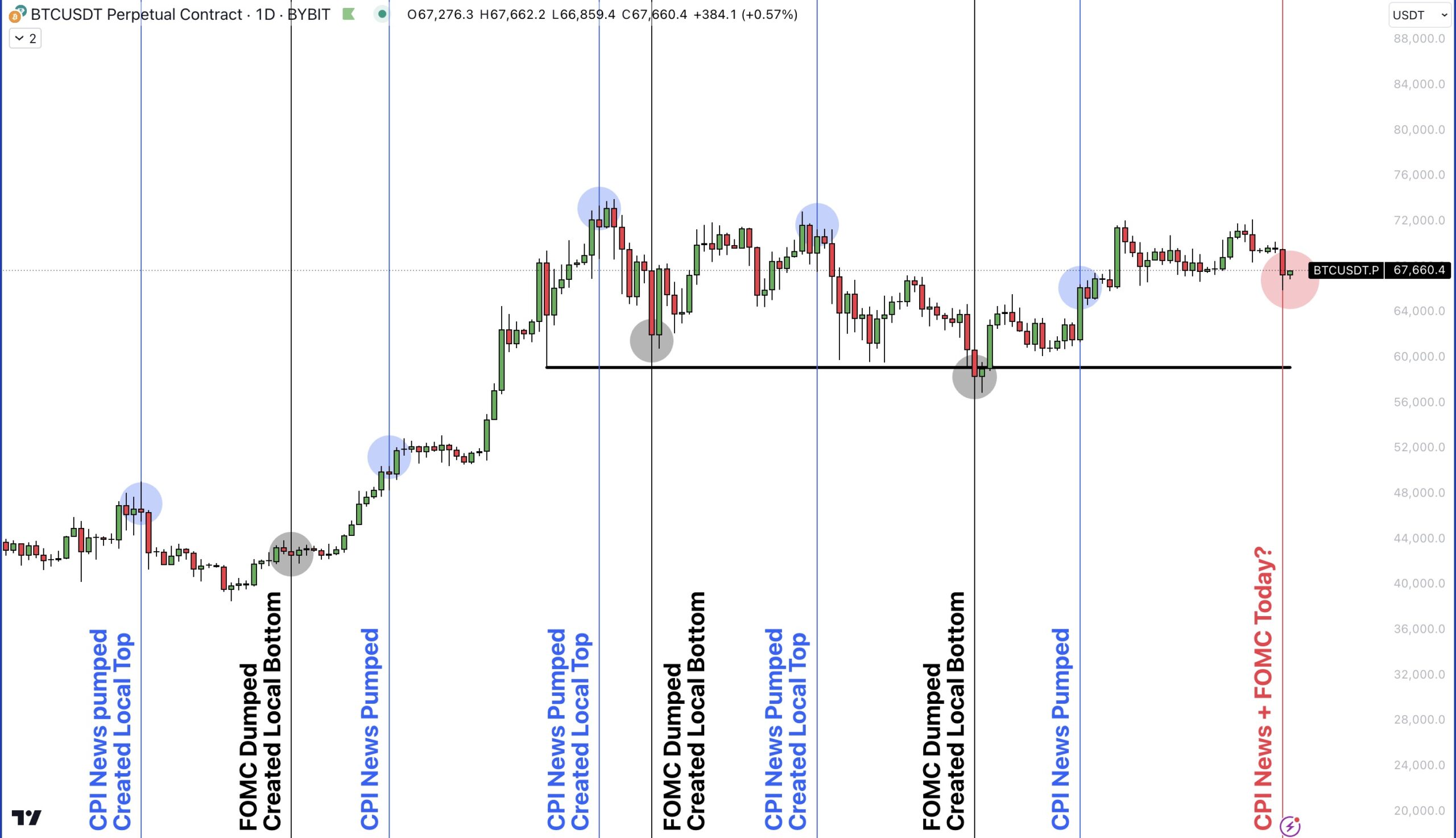

As we approach significant economic events such as the Consumer Price Index (CPI) releases and the Federal Open Market Committee (FOMC) meetings, it’s essential to understand their potential impacts on the market.

Understanding CPI and FOMC

The Consumer Price Index (CPI) measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It is a critical indicator of inflation. The Federal Open Market Committee (FOMC) is a branch of the Federal Reserve Board that determines the direction of monetary policy, including setting interest rates.

Market Patterns: CPI and FOMC

CPI Releases: Marking Local Tops

Historically, CPI releases often coincide with local market tops. Here’s why:

- Inflation Data Impact: High CPI readings indicate rising inflation, which can lead to concerns about tighter monetary policy. This often results in market corrections as traders anticipate potential interest rate hikes.

- Market Sentiment: Leading up to CPI releases, market participants may price in their expectations, causing price fluctuations. Once the data is released, markets may react negatively if the inflation numbers are higher than expected.

FOMC Meetings: Marking Bottoms

Conversely, FOMC meetings tend to mark local market bottoms. Here’s the rationale:

- Policy Announcements: FOMC meetings conclude with policy announcements that can reassure markets. If the Fed signals a dovish stance, indicating lower interest rates or continued economic support, it can boost market confidence.

- Market Stabilization: After a period of uncertainty leading up to the FOMC meeting, markets often stabilize as traders adjust their positions based on the Fed’s guidance.

Strategies for Navigating CPI and FOMC Events

1. Stay Calm and Informed

During times of market turmoil, maintaining composure and staying informed is vital. Track relevant economic data and understand the context of CPI and FOMC events.

2. Monitor Key Indicators

Keep an eye on key indicators such as inflation trends, interest rates, and economic forecasts. These indicators provide insights into potential market movements.

3. Adjust Trading Strategies

Based on historical patterns, consider adjusting your trading strategies around these events:

- Before CPI Releases: Be cautious of potential market corrections. Consider tightening stop-losses or reducing exposure.

- Before FOMC Meetings: Look for potential buying opportunities as markets may react positively to dovish policy announcements.

4. Diversify and Hedge

Diversify your portfolio to mitigate risks associated with economic events. Consider hedging strategies to protect against adverse market movements.

Chart: – Volatility to fade out after today – Chart not to scale

By understanding the historical patterns and implications of CPI and FOMC events, traders can better navigate the uncertainties of the market. Stay tuned to Coinstune.com for more insights, tips, and strategies to help you thrive in the world of cryptocurrency trading.

Happy trading, and may the markets be ever in your favor!